Diversification: The Key to a Secure Financial Future

What is Diversification and Why Is It Important?

Diversification is an investment strategy that involves spreading your money across a variety of assets, such as stocks, bonds, real estate, and commodities. The goal of diversification is to reduce risk and increase returns. By investing in a variety of assets, you are less likely to lose all of your money if one asset performs poorly.

Benefits of Diversification

Diversification can have several benefits, including:

- Reduced risk

- Increased returns

- Improved stability

- Peace of mind

How to Diversify Your Portfolio

There are several ways to diversify your portfolio. One way is to invest in a variety of asset classes. Another way is to invest in different sectors of the economy. You can also diversify your portfolio by investing in different countries.

Asset Allocation

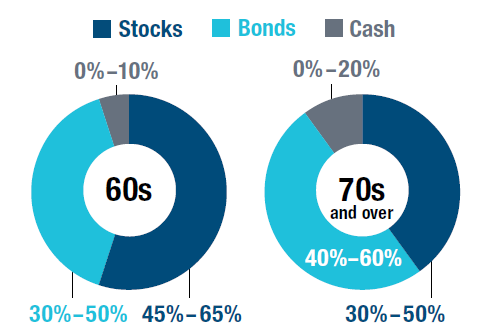

Asset allocation is the process of dividing your portfolio into different asset classes. The three main asset classes are stocks, bonds, and cash. Stocks represent ownership in a company and have the potential for higher returns, but also more risk. Bonds are loans to companies or governments and have the potential for lower returns, but also less risk. Cash is the most liquid asset and has the lowest risk, but also the lowest potential for returns.

Sector Diversification

Sector diversification is the process of investing in different sectors of the economy. The three main sectors are the financial sector, the technology sector, and the industrial sector. The financial sector includes banks, insurance companies, and investment firms. The technology sector includes companies that develop and sell products and services related to technology. The industrial sector includes companies that produce and sell goods and services.

International Diversification

International diversification is the process of investing in different countries. By investing internationally, you can reduce your exposure to the risk of any one country. However, you also need to be aware of the risks associated with investing in foreign countries, such as currency risk and political risk.

Diversification in Practice

Diversification can be implemented in several ways. One way is to create a diversified investment portfolio. Another way is to use mutual funds or exchange-traded funds (ETFs). Mutual funds and ETFs are professionally managed investment funds that offer diversification across a variety of assets.

Investment Portfolio

A diversified investment portfolio is a combination of different asset classes, sectors, and countries. When creating a diversified investment portfolio, you should consider your risk tolerance and investment goals. You should also rebalance your portfolio regularly to ensure that it remains diversified.

Mutual Funds and ETFs

Mutual funds and ETFs are professionally managed investment funds that offer diversification across a variety of assets. Mutual funds are actively managed by a fund manager, while ETFs are passively managed and track an index. Both mutual funds and ETFs can be a good option for investors who want to diversify their portfolios without having to manage individual investments.

Conclusion

Diversification is an important investment strategy that can help you reduce risk and increase returns. By investing in a variety of assets, you can create a portfolio that is tailored to your risk tolerance and investment goals. Diversification can also help you achieve peace of mind, knowing that your money is invested in a way that will help you reach your financial goals.

Komentar